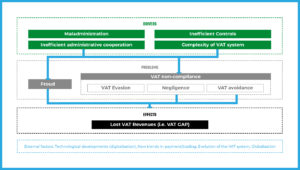

Every year the European Union (EU) countries lose billions of Euros in Value Added Tax (VAT). This loss is mostly explained by the inadequate and complex VAT collection system in place, leading to VAT fraud, VAT evasion, non-compliance and negligence.

*VAT Gap is a measure of VAT compliance and enforcement which together provides an estimate of revenue loss.

“The latest analysis of missing EU VAT (the ‘VAT Gap’) from fraud, bankruptcies and poor administration is €151.5 billion in 2015.” – European Commission VAT Gap Study 2017

VAT fraud and VAT evasion are a huge problem which directly or indirectly affects all countries within and outside of the EU. To tackle this problem, the EU and the individual Member States have introduced various measures over the years. One of the recent initiatives is the split payment mechanism to effectively enforce VAT compliance, make the system VAT fraud proof and thus reduce the VAT Gap.

What is split payment and how does it work?

It is a new method of VAT collection to combat VAT fraud and non-compliance. In this system invoices paid to the supplier’s account are divided into two parts:

- The net price of the commodity will be deposited directly to the supplier’s business bank account.

- The VAT amount will be deposited to the supplier’s dedicated VAT account.

Prior to the introduction of the split payment mechanism, alltax authorities of the EU member states depended on a vendor-based collection system, where the suppliers were expected to pay the VAT on a periodic basis. This often led to tax fraud, negligence and evasion which contributed to the VAT Gap in the EU.

The new system implemented in some of the member states helps eliminate the possibility of VAT fraud and evasion as suppliers will be paying upfront the VAT to the tax authority.

VAT collection systems like the split payment mechanism are today largely used in countries outside the EU. For example the Government of India has created a centralized platform called PayGov for its citizens to pay for all government departments and services. At the backend, the system divides the payment to and subsequent departments.

In Europe, Italy, Poland and Romania have recently introduced split payments and the UK is considering implementing such a regime.

In Italy, the split payment mechanism is applied to goods and services provided to public bodies as well as companies included in the Financial Times Stock Exchange ( FTSE MIB index). As per the split payment scheme in Italy, customers pay the net amount to the supplier’s bank account and VAT amount to the VAT bank account allocated to them by the authorities.

In Poland, the customers will have to make the payment only to the bank who will then divide the payment between the supplier account and the allocated bank account. However, the Polish authority has not mandated the application of split payment mechanism and businesses can choose to not apply it.

In Romania, the split payment mechanism is mandatory for businesses exceeding the threshold of outstanding VAT liabilities. They are required to open a separate bank account for VAT collection and payment purposes. Romanian VAT is charged on all taxable goods and services. It is the customer who splits the payment and transfers the VAT directly to the supplier’s VAT account.

Benefits of a split payment mechanism

-

Reduction of VAT fraud & non-compliance

Minimisation of VAT fraud is considered to be one of the biggest advantages of the split payment mechanism. The European Commission believes the VAT Gap may be reduced by as much as 21% under the new system, with the most notable decline from the Missing Trader Intra-Community (MTIC) fraud.

As per the public accounts committee records, even big players in the online marketplace like Amazon and eBay were overlooking the fact that their sellers are selling goods without paying the 20% VAT to the tax authorities costing the public purse an estimated whopping £1.5 billion! They are now taking extra measures to avoid VAT frauds by giving the tax officials access to their entire database in order to fight the tax evasion by overseas online retailers.

However the new split payment mechanism requires a thorough reporting system providing full transparency in order to bring VAT fraud to an all time low.

-

Contributing to the Reduction of VAT Gap

In 2015, the VAT Gap in the 28 EU-Member States amounted to an estimated €151.5 billion. Though the VAT Gap is not only made up of VAT fraud estimates, the new VAT collection system will help avoid tax overdue and reporting errors, which significantly contribute to the VAT Gap.

-

Accelerate the process of tax payment and make it more secure

Another significant advantage of the split payment system is that it is quick, with the VAT being split at the time of payment and transferred directly to the suppliers nominated VAT account making the VAT transaction more secure by eliminating possibilities of VAT fraud. The new system offers the tax authorities incredible control as it allows them to extract the VAT from the transactions in real time.

Additionally, the new system prohibits business entities to use the money in the VAT account for any other purposes than those related to its VAT operations. In case business entities want to transfer funds from the VAT account to their current account, they will need special consent granted only by the tax authorities. This will further reduce the chances of VAT fraud and help decrease the VAT Gap.

Impact of the split payment system

The introduction of the split payment mechanism to collect VAT in the EU will impact the economy in several ways. Some of them are as follows:

-

Significant impact on the cash flow

The introduction of the split payment mechanism throughout the EU would heavily disrupt cash flow in the economy. The real-time payment of VAT invoices will result in a positive cash flow for the tax authorities. On the other hand, companies will notice a negative impact on their cash flow as they will have to pay the VAT immediately or at best have it set aside in its own dedicated account as opposed to paying the VAT on a periodical basis as we still do in most countries.

-

Rise in administration cost to businesses as well as public sectors

Collecting VAT through the new mechanism will lead to a rise in the administration costs to businesses as well as the tax authorities. The VAT is collected on a transaction basis for B2B as is the case with the electronic fund transfers for B2C. As a result, this puts a significant burden on the public bodies due to increased reporting requirements.

As the new system processes single transactions due to real-time transaction based VAT collection, it is estimated that the authorities will be facing at least a 70% rise in their operational costs. The way the new regime will impact individual businesses will vary, today they have to collect VAT per transaction so in this respect the difference is less arduous than on the authorities. Progressively, as more parts of the new system embrace automation, the administration cost will come down.

-

Delay in processing VAT refunds

One of the problems observed in Italy is the backlog in processing VAT refunds to businesses. For example in Italy, the tax authorities are unable to process due VAT refunds 90 days after the quarterly refund request is made. This delay largely impacts the liquidity of businesses in Italy, while the government is earning interest.

-

Effect on Cross-Border Refunds

The introduction of a split payment system directly affects local VAT registered businesses in the concerned country . For a foreign company that is not registered for VAT in the country, the split payment system might affect the collection side of the VAT, on the occasions when a foreign invoice is paid with VAT.

It should not impact the cross-border (8th/13th Directive) refunds procedure as this is still a separate procedure.

The cost of the split payment mechanism outweighs its benefits

As per the split payment system impact study, there is no strong evidence that the benefits of split payment will outweigh its costs. Additionally, the definitive regime, even without split payments, is expected to reduce the MTIC fraud by 83% and consequently the VAT Gap.

What does this mean for you as a business for claiming VAT refunds?

- Within the EU, the split payment mechanism system has been introduced in Italy, Poland and Romania. If you have business activities in any of these countries then certain changes with regards to VAT reporting will apply.

You may have to make administrative and technological changes to your own VAT tracking and reporting activities.

- Largely, the new VAT collection system within these countries applies to the VAT registered sellers of goods and services. However, for a detailed assessment of the implications by country see the attached resources: Italy, Polish, Romania.

- In the new system, the charged VAT gets deposited in the supplier’s VAT account separately with restricted access to the suppliers. Due to this, businesses have experienced a reduced cash flow.To aid small businesses, VAT refunds can be delayed if they opt for the schemes which allow them to submit the returns less frequently.

- Businesses will have to make certain changes in their processes and systems to adhere to the guidelines set by the new system:

- Changes to the current ERP systems with regard to document transactions and reporting

- Additional data reporting for invoices – invoice reference, the customer VAT identification number and amount of VAT paid

- A separate record of all transactions that are subjected to split payments for auditing and refund process

- The businesses are allowed to correct a payment that is incorrectly paid by the beneficiary into an account other than the VAT account within 7 days. However, if the correction is delayed, a fine of 0.06% per day will be levied by the authorities (currently only applied in Romania).

My final take – Is split payment policy even needed?

The study findings show no strong evidence that the benefits of the split payment system would outweigh the related administrative costs and impact on businesses. However, if split payments applied on a much wider scope it would potentially provide a much more significant decrease in the VAT Gap. Taking into account the ongoing VAT policy developments (the definitive regime) to improve and modernise the current VAT system to be a Single VAT Area. The EU will be able to combat VAT fraud and avoid huge losses in tax revenue and make it easier for companies wanting to do business in the EU Single Market.

Companies across the world regard us as a leader in cross-border VAT recovery and foreign VAT advisory. With the implementation of split payments, contact us to help you stay on top of your VAT compliance and VAT recovery landscape. Connect with us today!

Get next update straight to your inbox

My team and I are closely monitoring this and will write updates to this. If you are not already subscribed to our blog, you can do it just by entering your email address. All updates related to this and other related issues will come straight to your inbox.